Upfront funding for landlords, repaid by their tenants.

Wectory is a service for landlords to get upfront funding in exchange for a discount and for their tenants to manage their payments via the app.

Simply add your property to the Wectory app and send an invite to your tenant. Then, choose how many monthly payments you would like to get upfront and approve Wectory service conditions.

That's it - Wectory will then send the funds directly to your account.

Tenants pay as normal – but with a smoother experience. Along with the usual direct debit payments, tenants enjoy personalised statements in the app and additional notifications.

Real estate as an industry has remained unchallenged throughout all of these years. For the industry worth more than 217 trillion dollars in 2020, big innovations are urgently required.

One of the most widely shared definitions, by the founder of Unissu, the platform for PropTech start-ups James Dearskley:

“PropTech is one small part of a wider transformation in the property industry. It considers both the technological and mentality change of the real estate industry, and its consumers to our attitudes, movements and transactions involving both buildings and cities”.

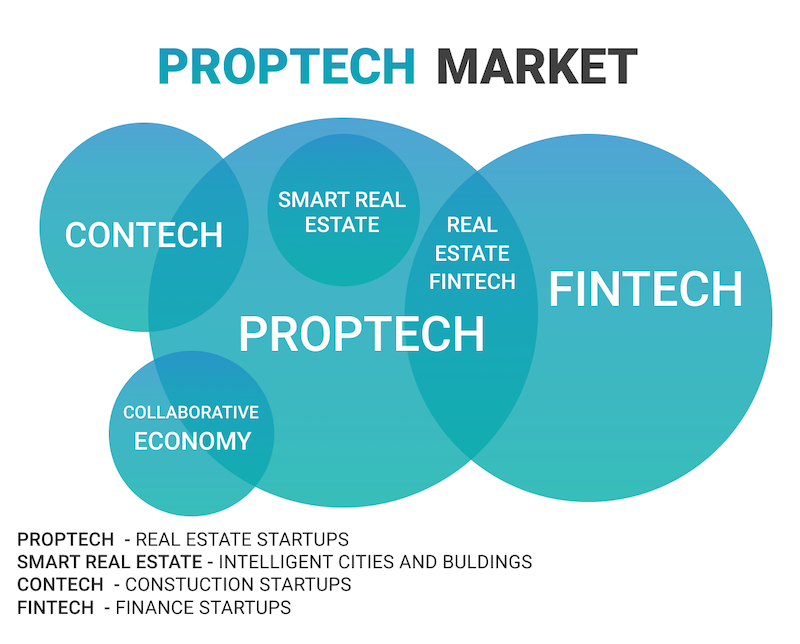

Today, several verticals emerge within PropTech: the real estate market perse (PropTech), smart cities and buildings, the sharing economy, the home building industry (ConTech) and finance (FinTech).

Both ConTech and FinTech have very close ties with the real estate industry. To have a better understanding, have a look at the Venn diagram below:

Source: University of Oxford Research, PropTech 2020

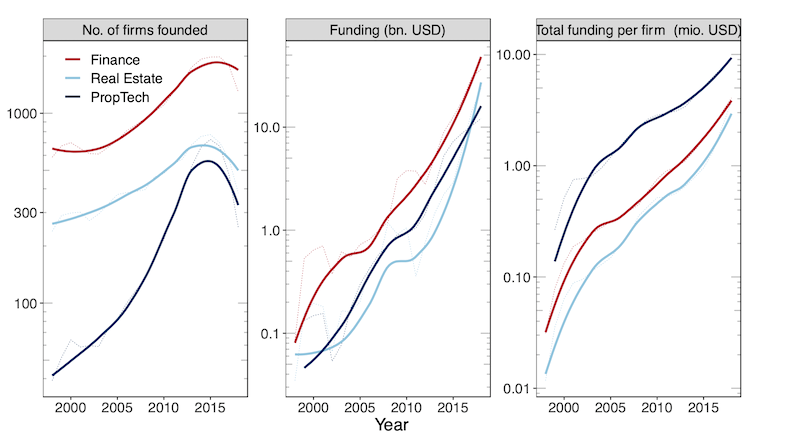

Indeed, the PropTech is a new buzzword on the internet but, the number of founded PropTech start-ups globally have significantly skyrocketed particularly from 2004 onwards, reaching their peak in 2015 and beginning to diminish in the same year – references may be drawn from figure 1 below.

However, the overall funding per property-tech firm continues to rise with some minor fluctuations. It should be acknowledged that the total secured funding per PropTech firm is higher than in finance or real estate companies.

Figure 1 displays the total number of founded firms worldwide, while also showcasing the summed-up funding (per billion, in U.S. dollars), and lastly, incorporates the total funding per firm (per million, in U.S. dollars).

At the moment of writing this article, more than 8200 PropTech firms are being tracked globally and 424 of them were tagged inactive recently. This number is more optimistic than the average start-up fails rate, so expect the number to increase up to 70% in 10 years. Not to mention that the giants like Airbnb, Compass or Opendoor would prioritise expansion, thus creating barriers to entry for new businesses.

It seems that the successful innovation in PropTech is always related to data, modified search engines platforms for listing and partially improvement in the management of properties. Most start-ups thus fall into one of two categories: either they offer support for real estate professionals by simplifying their day-to-day tasks or propose rewriting everything from scratch by replacing real estate professionals.

However, believe it or not, the real estate agents are going to stay. In times of unprecedented adaptation of technology everywhere, the customercentric strategies would be required the most and they would have to be offered by agents. For instance, every reader experienced long queues with banks or telephone companies and wondered: “Can I just speak with a real person?” No wonder, that letting expensive properties or even more, selling them - would create an outrage by relying on algorithms that would estimate the value of a property below the market price only to get rid of it “efficiently”.

Another possible area coinciding with property is banking, where there are no worries about newcomers. However, there is a niche for FinTech cowering transactions and funding for landlords. Landlords are sick of mortgages, loans with high percentages and something must be done about it. It is needless to mention, that the job of a landlord has become even more challenging in recent years. For example, the new tax rules have prohibited offsetting the mortgage interest costs against the rental profit. Furthermore, the introduction of the capital gains tax for property which has appreciated in value has sadly only decreased the possible profits for landlords. However, one of the UK based startups, called Wectory aims to revolutionise the funding of landlords by providing upfront capital. The model is simple - upfront money for a small service charge in the end. Landlords would be able to restructure their finances and resolve potential cash flow problems, whereas tenants would be happier with sending smooth payments through a convenient mobile app.

In addition, the current global demand suggests that real estate tech solutions would also need to prioritise sustainability. Following PwC “2020 Building the Future” report, the global stock of institutional-grade real estate will expand by more than 55%, reaching a potential £50 trillion in 2030. “All building will need to have ‘sustainability’ ratings, while new developments will need to be ‘sustainable in the broadest sense, providing their residents

with pleasant places to live”.

In the end, the problem with PropTech is more deeply rooted. Even though the property market remains resistant to any alterations, one of the crucial players remains the government which slowly adapts new laws, however, that would be a completely new story.

Mykola Kuzmin, 21 March 2020