PayProp

How to stay on top of arrears during a global pandemic

08 October 2020 23682 Views

Many have speculated, though much of it is anecdotal – how is the UK rental market coping with the fallout from COVID-19, and what’s likely to happen as lower levels of restriction persist?

Six months into the global pandemic, a new special report from PayProp gives data-driven insights into the fortunes of one of the first sectors to reopen after the nation went into lockdown.

Without downplaying concerns, the quarterly report (June – August 2020) balances the damage of the country’s worst recession since World War II with the technological opportunities that the industry is starting to seize. Among countless other reports on the impact of COVID-19, its findings are concise and easy to digest.

The state of the market

PayProp’s report makes an important distinction between government support given to rentals and sales – explaining how a higher stamp duty threshold has helped stimulate demand for house buying. For rented properties, by contrast, the data from July to August shows that more and more tenants are falling into arrears and the amount they owe is increasing.

However, when digging deeper into the numbers, there is good news and improvement throughout the three-month period. The percentage of tenants in arrears has dropped from a high of 15.6% in May to 14.1% at the end of August. The numbers also show a significant 2.2% reduction of tenants in arrears from May to June.

Focusing on the next few months

As redundancies mount and government support tapers off, the report concludes that agents need to maintain their proactive approach to arrears chasing – and advises them to use technology to help reduce arrears and build resilience for more difficult months ahead.

By implementing PayProp and automating their arrears-chasing process, featured new client Griffin Residential highlights the success of PropTech automation, having used it to cut their total arrears by over £60,000 – with results visible in three weeks.

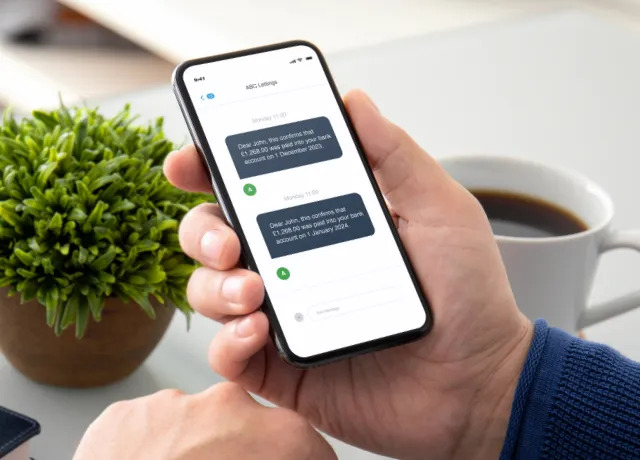

For those less familiar with PayProp, the report explains how PayProp’s bank-integrated client accounts work, allowing agents to check the arrears status of any tenant in real time – plus the effectiveness of easy-to-send e-mail and text message payment reminders in encouraging payment.

Understanding the bigger picture

To help the sector visualise the whole picture across the country, rental payment data from each region is also profiled, with significant variances seen in some areas including the East Midlands and the East of England. Being able to compare themselves against regional and national averages will put agencies in a strong position to benchmark themselves and set achievable arrears reduction targets.

The report does raise some crucial questions about how furloughed tenants will cope after the termination of government support such as the Coronavirus Job Retention Scheme, which will become clear in the next set of quarterly results.

Want to understand more about the impact of the pandemic on the rental market and the role of payment automation in addressing this?

Download the full report today, for free.

Previous Articles

Looking for a client account?...

Faster payments make happier landlords...

Client money accounting made easy...

Help your landlords recover rent...