PayProp

5 regular checks to keep any rental portfolio in tip-top shape

24 April 2023 6609 Views

.jpeg)

Any lettings portfolio should receive ongoing care and maintenance. A disorganised portfolio, weighed down by junk data, loose ends or lax processes enabling wrongdoing, can disrupt the flow of operations, reduce productivity, expose the business to risk and ultimately cause sleepless nights.

1. Check for deposit consistency

Quite simply, all deposits, whether they held in your company’s client accounts or not, must be registered with a valid tenancy deposit scheme. There are two types, custodial (where the scheme holds the deposit) or insured (where the letting agency holds the deposit but pays a fee to keep it insured).

In the first instance, any cases of active tenants who don’t have deposits should be investigated, unless there’s a valid reason for this. This will clear up any confusion around absent or oddly valued deposits and can be the starting point for any deeper investigations that may reveal other irregularities.

But it’s inactive tenants who still have damage deposits against their names that need attention most frequently. Checking your client account for this regularly to ensure deposits are paid out as soon as possible after a tenant has moved out, as it is against the law to keep a deposit. Once that’s resolved, and for added peace of mind, properties on PayProp can be “disabled” upon vacancy, at which point recurring invoicing will stop automatically.

By running deposit reports on PayProp, ensuring expired contracts are no longer invoiced, and always returning money to its rightful owner, the agency can be sure its books are always tidy and client accounting issues won’t crop up later down the line. In addition, if an agency uses an insured deposit protection scheme, it may be paying too much or too little if it fails to tell the insurance provider the accurate total of the deposits held. By running the deposit report and returning the money promptly, the agency could save on its insurance.

2. Verify credit notes

Credit notes, credit memos, journals, entries – no matter what they are called in the business, they should only be used to correct mistakes, or when funds from another source (like a damage deposit) were used to reduce an outstanding amount. (And to be clear, this should be highly exceptional and not the rule.) Excessive or unexplained credit notes pose a risk to the business, its client accounting process and its reputation.

With PayProp, it’s easy to see how many credit notes were created in relation to the number of invoices generated for the same period, and to make sure each one includes a clear description of why it was created, to avoid any misunderstandings. Any discrepancies are worth investigating. The platform’s audit log will even record which user created the credit note, making it easy to find the right person to ask why it was needed.

PayProp’s customisable permission settings allow the creation of credit notes to be restricted to authorised users, giving businesses complete client accounting control.

3. Monitor credit balances

It’s important to not only check tenant statements to see if specific accounts are in credit, but also whether they are in arrears. A portfolio becomes messy when arrears are not handled promptly, and the messier it gets, the harder it is for the principal to analyse or recoup outstanding amounts, which increases risk.

PayProp’s advanced arrears tech automatically flags when a payment is missed and allows agencies to chase any outstanding amounts over e-mail and text message. The platform’s arrears messages have been refined over time, so it gets results – 64% of tenants respond within 48 hours.

4. Manage notifications

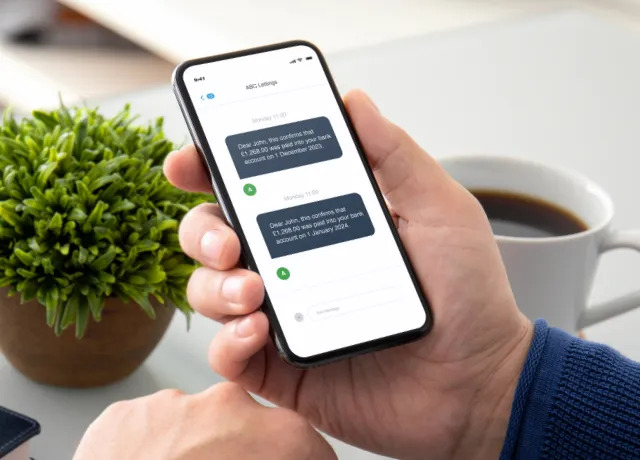

Notifications sent to beneficiaries (e.g. owners) and payers (e.g. tenants) whenever a transaction is made on a relevant property saves time and prevents confusion. PayProp’s automated and bank-accurate client communication keeps everyone up to date on the status of their monies.

It could be the single most important move an agency can take to reduce errors, omissions, and miscommunication.

5. Action outstanding rental invoices

A daily general sweep of any outstanding invoices can save time and money in the long run. Try to ensure that even small pending deposits are not left unallocated in your client account, as they can add up and become costly. Failed beneficiary payments can alert the agency to issues that are easy to overlook but nevertheless important to address, such as closed accounts or incorrect banking details.

PayProp’s dashboard gives an agency a live comprehensive portfolio summary that includes the amount of outstanding invoices every time a user logs in.

BONUS: Peripheral services available only to PayProp clients

Agents who use PayProp have several additional tools at their disposal that help streamline their day-to-day business and client accounting operations on the platform and make their lives easier. The platform offers landlord and tenant visibility and self-service through the Owner app and Tenant portal, as well as instant online payments, maintenance ticketing and other industry-leading functionality, included for free or at a minimal cost.

Agencies can take advantage of these tools and processes – either as an existing PayProp client or when onboarding – to maintain the integrity and health of their rental portfolio and raise their value proposition to clients. If you are not a PayProp client, book a demo today to keep your rental portfolio in tip-top shape.

Previous Articles

Looking for a client account?...

Faster payments make happier landlords...

Client money accounting made easy...

Help your landlords recover rent...